- Investment is typically in the form of a royalty, and may include a right to finance future project development

- Investment proceeds are generally directed towards exploration or early project development activities

What is a Precious

Metal Stream?

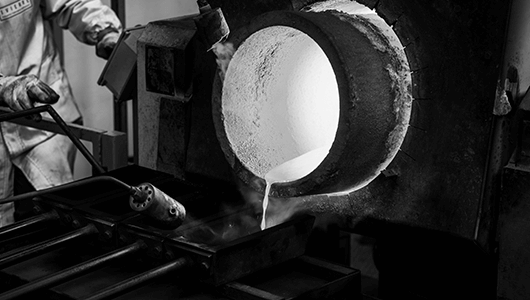

A precious metal stream a purchase agreement that provides an upfront capital payment for mine development in exchange for a percentage of gold output at a below-market cost, in most instances up to an 80% discount to the current commodity market price.

Metal stream acquisitions are often larger in size than royalty acquisitions, have more flexibility in the negotiation of terms and conditions, and generally provide both parties with tax advantages.

Stream / Royalty

Investment Process

PHASE OF PROJECT

DEVELOPMENT

- Investment is typically in the form of a stream, or a royalty with a right to finance further project development

- Investment proceeds are generally directed towards project development activities

- Investment is typically in the form of a stream

- Investment proceeds are generally directed towards Production expansion, development of new projects, or other corporate requirements

- Payment from Royalties: a right to a percentage of revenue or metals produced from the project after deducting specified costs, if any

- Payment from Streaming: a right to purchase metal production at a predetermined price

Our Streaming

Model

After identifying a potential opportunity, we use the production profile and reasonable commodity price assumption scenarios to map out expected cash flows over the life of the stream.

Using the appropriate discount rate, future cash flows are discounted to determine the value of the stream if it were in our portfolio, which is the maximum price we’d be willing to pay.

3-Fold Business Model

NEWSLETTER