- The potential upside valuations of royalties increase substantially from pre-resource properties to producing mines.

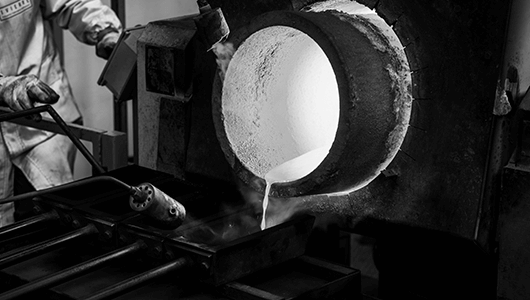

What is a royalty?

A Royalty is the right to receive a percentage or other denomination of mineral production from a mining operation. New royalties are created by providing capital to an operator or explorer in exchange for a royalty. The capital provided is typically used for the development and construction of a mine, mine expansion, or funding exploration work.

Types of Royalties

The Company’s portfolio will contain several different kinds of royalties or similar interests which are defined as follows:

Gross Proceeds Royalty

(GPR)

A royalty in which payments are made on contained ounces rather than recovered ounces.

Gross Smelter Return

Royalty (GSR)

A defined percentage of the gross revenue from a resource extraction operation less, if applicable, certain contract-defined costs paid by or charged to the operator.

Gross Value Royalty

(GVR)

A defined percentage of the gross value, revenue or proceeds from a resource extraction operation, without deductions of any kind.

Net Profits Interest

Royalty (NPI)

A defined percentage of the gross revenue from a resource extraction operation, after recovery of certain contract-defined pre-production costs, and after a deduction of certain contract-defined mining, milling, processing, transportation, administrative, marketing and other costs.

Net Smelter Return

Royalty (NSR):

A defined percentage of the gross revenue from a resource extraction operation, less a proportionate share of incidental transportation, insurance, refining and smelting costs.

How Do Royalty

Interests Work?

- Exploration potential of a

pre-resource property increases the gold resource and the royalty’s value.

- The royalty value on

pre-production & fully permitted properties typically increases 2-3 times once mine production financing is secured.

ROYALTY VALUE BY

DEVELOPMENT STAGE:

Production

1% (NSR) royalty on 1m oz Gold deposit of a producing (Mine) property has a current market value of approx. $9m or 50% of the total gross value (10,000 oz’s @ $1800 oz = $18m).

Pre-Production

1% (NSR) royalty on 1m oz Gold deposit of a pre-production (fully permitted) property value is approx. $1m in an combination of cash and Nevada Canyon share equity.

Exploration

1% (NSR) royalty on 1m oz Gold resource, exploration property is approx. $500K in an combination of cash and Nevada Canyon share equity.

Exploration (Initial)

1% (NSR) royalty on 100K oz initial Gold resource (1000 oz’s), exploration property is approx. $50K in an combination of cash and Nevada Canyon share equity. (Potential initial value of 1000oz @ $1800 oz = $1.8m)

Additional

Identified Royalty

Acquisitions

Subject to Completion

of Financing

Nevada Canyon Management and their industry contacts have identified up to ten potential additional royalty acquisitions within Nevada. The potential gold mineralized property royalties range from producing mines, pre-production, initial resource, and pre-resources gold mineralized properties. Nevada Canyon estimates an initial funding in the range of $20M, along with Nevada Canyon share equity, would be sufficient in securing these mineral property royalties.

ROYALTIES & STREAMS

POTENCIAL ON

OVER 30,000 SQ MILES

NEVADA IS ONE OF

THE WORLDS

PROLIFIC MINING CAMPS

DECADES OF

FUTURE EXPLORATION

POTENTIAL

3-Fold Business Model

NEWSLETTER